Education | Jan 18, 2022

A Lesson for Plan Participants — Harness the Time on Your Side

"Time is the coin of your life. It is the only coin you have, and only you can determine how it will be spent."- Carl Sandburg¹

The COVID-19 pandemic and its accompanying economic crisis have put tremendous pressure on businesses and their employees. For many organizations, keeping employees engaged and invested in their company retirement plan has been particularly challenging. Not to mention, this task is in addition to the tricky balance of hiring and retaining key talent. Plan sponsors and business leaders, however, play a critical role in supporting and educating retirement plan participants, and ultimately share in the responsibility of ensuring their employees' retirement and financial security are allocated wisely and on the desired track.

Four Key Retirement Plan Principles

Recently, we have been discussing an increasingly unsettling trend with plan sponsors: convincing employees to maximize their retirement plan benefit is becoming more and more difficult. Specifically, four basic and key principles are going unrecognized and unimplemented by employees: 1) beginning to save early 2) utilizing a tax-deferred company sponsored retirement plan to do so 3) fully realizing the company match and 4) remaining consistently invested with funds appropriately allocated to the proper mix of assets classes (e.g., stocks and bonds).

Harnessing the Power of Time

To help resolve these issues, we point out that the binding thread between these four principles - and what can make them so powerful if implemented - is actually quite simple: time. The power of compounding (the exponential growth of investment gains over decades) is all about participants’ money being invested to earn a return (i.e., more money), and that money earning more money, and so on. Simply put, the four key principles of saving early, using a tax-advantaged plan in which to save, fully realizing the company match, and implementing a consistent and proper asset allocation maximizes this powerful phenomenon to achieve preferred results for participants.

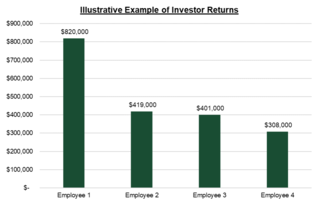

Here is an easy-to-understand scenario we often use in our employee presentations: Employee number one starts early, at age 25. She contributes $5,000 per year for forty years ($200k). With an average annual return of 6%, she accumulates $820,000 for retirement. Employee number two starts saving at age 35, also contributing $5,000 per year but for 30 years ($150k). At retirement, assuming the same 6% return as employee number one, she has accrued a total of $419,000, only about half the amount saved by employee number one.

Yet another employee - employee number three - starts at age 25, invests $5,000 per year, but stops in ten years at age 35. Even though he has only contributed $50,000, as opposed to the $150,000 invested by employee number two, he still accumulates $401,000 at retirement due to the impact of saving early and staying invested over time.

In a final example that demonstrates the importance of how the savings is invested, employee number four saves $5,000 per year for 40 years ($200k) but invests only in low-risk cash alternatives. With an average return of just 2%, he saves only $308,000. That 2% return per year likely fails to keep up with inflation, causing the value of the portfolio in real terms to decline. Investing at least a portion of the savings in riskier assets is one of the best ways to ensure keeping up with inflation over time.

In addition, many plan sponsors have expressed their concern about employees not contributing enough to receive the full employer match, even though it provides an immediate guaranteed return per dollar invested. Research shows that a typical employee who did not receive the full match left $1,336 of potential “free money” on the table each year. Incorporating the compounding of investment gains, this could amount to as much as $42,855 over 20 years.

If employees were offered a $1,300 bonus, it’s a safe bet that they would all take it. So why do so many of them pass up this opportunity? Is it inertia, lack of awareness, lack of education, or a combination of all three? The stark reality is that many participants do in fact miss out on receiving the full company 401(k) match because they are not saving enough, and others miss out because they are not saving at all.

For plan sponsors, adding automatic enrollment to a plan may be a consideration to allow more employees to take advantage of the employer match, though this solution has both pros and cons and it is important to first flesh those out before making a decision.

The Importance of Proper Asset Allocation

For retirement plan participants, it is time in the market that counts. Keeping one’s money invested over decades, frequently adding to that principal balance through additional contributions, and taking advantage of the benefits of a company-sponsored plan such as a match and tax-deferral is a sound strategy toward long-term financial independence.

Many plan participants, though, face the challenge of selecting the proper mix of funds, or in some cases, become emotional when checking their balances during periods of market stress. While not uncommon, all self-directed retirement plans should allow for participants to invest with a level of risk that is appropriate for them. Creating the right allocation of stocks, bonds and cash is critical, and can be accomplished in a number of ways, specifically through financial education or professionally-managed allocation models.

Just as important as the allocation itself is allowing that allocation to do its job over time. Over the past 91 years, the S&P 500 (a measure of US-based large company stock performance) has had negative results in 27% of those years, while the compound annual return over that time is about 10%.2 Again, for example, $100 invested then would be worth over $600,000 today. Compounding, as Einstein said, is the 8th Wonder of the World.

On the other hand, research demonstrates that short-term investors - those moving in and out of the market - tend to produce negative results. Trying to time the peaks and valleys of market returns is exceedingly difficult. Very few participants, or professional investors for that matter, can consistently predict when the absolute peaks and troughs will occur. As a result, this strategy also requires one to properly time the next decision (i.e., choosing when to buy back in or when to sell again).

Additionally, those participants opting not to invest at all due to the anxiety caused by making an inopportune decision face a different challenge, but ultimately the same outcome. Inaction may reduce anxiety in the short-term, but it may ensure they will also miss long-term gains and the compounding of those gains.

Conclusion

By understanding the power of compounding returns over decades, staying invested with the proper allocation, capturing the value of company matches, and capitalizing on the advantages of tax deferrals, participants may feel more compelled to contribute to their plan. It also reminds them that sponsors care about their wellbeing and security beyond their time at work, which may also help with retention.

Plan sponsors play a critical role in educating participants on the importance of saving early and consistently, as well as knowing what benefits the plan provides: tax benefits, employer contributions, access to what should be well-vetted, quality fund managers at a reasonable cost, and assistance with asset allocation. With guidance and support, employees can create a plan to better navigate the financial pressures they’re facing today, and help advance better retirement security for tomorrow. It really is all a matter of time.

Steve

¹ American Poet, As quoted without source in The School Musician Director and Teacher Vol. 43 (1971) by the American School Band Directors' Association

² Capital Group, American Funds. "Time, not timing, is what matters"

This material has been provided for general, informational purposes only, represents only a summary of the topics discussed, and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice or recommendations. Rather, they simply reflect the opinions and views of the author. D. B. Root & Company, LLC. does not provide legal, tax, or accounting advice. Before making decisions with legal, tax, or accounting ramifications, you should consult appropriate professionals for advice that is specific to your situation. There can be no assurance that any particular strategy or investment will prove profitable. This document contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information derived from such sources, and take no responsibility therefore. This document contains certain forward-looking statements signaled by words such as "anticipate," "expect", or "believe" that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that the expectations, beliefs, views and opinions expressed in this document will come to pass. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.