A Further Look | Nov 22, 2022

Prescription for Managing an Ailing 2022

David B. Root, Jr.CFP®

CFP®

“Don’t find fault. Find a remedy; anybody can complain.” Henry Ford

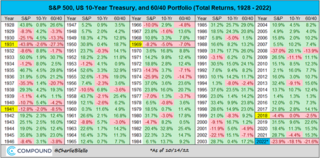

None of us could have predicted that 2022 would be this bad for global markets. The downturn is a result of four-decades high inflation and the hawkish response from the Federal Reserve. No major asset class has been spared. Stocks, bonds, real estate, and cryptocurrency have all been decimated. The result has been historic, as there have only been five instances when stocks, bonds, and the 60/40 portfolio have all generated negative returns for investors in a calendar year – 1931, 1941, 1969, 2018, and now 2022. Even during the great financial crisis of 2007-2008 (GFC), you could hide your money in bonds, which returned 20.1% that year. As you can see by the chart below, the only year that looked worse than 2022 for equities and the 60/40 portfolio was 1931…who would have thought?

The monetary lessons of 1931 and 2008

The Great Depression—the longest and deepest downturn in US history—began in 1929 and lasted more than a decade. The Federal Reserve, along with Treasury Secretary and Pittsburgh’s own Andrew Mellon, implemented fiscally prudent policies that they thought would provide relief to a suffering public. Unintentionally, some of their decisions hurt the economy, including raising interest rates in 1928 and 1929. The Fed did so in an attempt to limit speculation in securities markets – one of the factors most associated with the excesses of the ‘roaring twenties.’

A reminder from my grandfather who started his own investment firm in the early 1930s: “if you want to dance, you have to pay the band!” Unfortunately, the actions of 1928 and 1929 slowed economic activity in the United States, and the Fed repeated the mistake of raising interest rates in the fall of 1931. In this case, the roaring twenties were “the dance", and the sobering consequences of rate hikes that were deemed necessary to remedy the subsequent Great Depression were how the nation collectively “paid the band.”

Many years later in 2002, Ben Bernanke, then a member of the Federal Reserve Board of Governors, acknowledged publicly what many economists believed: The Federal Reserve’s mistakes in raising interest rates contributed to the Depression. Fast forward to 2007 and Bernanke, now Chairman of the Federal Reserve, likely sought to avoid committing the same error as his Great Depression predecessors. In fact, he ventured in the opposite direction by initiating Quantitative Easing (QE), a dovish policy that seeks to reduce interest rates and stimulate economic activity through large-scale asset purchases funded by the Fed’s balance sheet.

Today’s interest rates, which are high compared to recent history but remain below long-run average levels, have exposed the dark side of QE. Although it was introduced as an emergency response to the GFC, QE has since become the main policy tool of advanced-economy central banks. The experiment felt good initially—increased liquidity and low rates buoyed equity markets and spurred business activity. Lying on the sofa and eating snacks also feels good, but it isn’t necessarily a sustainable habit to employ for the long term.

While central banks tend to deploy QE in response to short-term bad news, they haven’t proven eager to reverse course when the bad news ends. QE remains for longer than is healthy.

Using the GFC as its guide, the Fed added fuel to the fire when they exercised an enormous scale of purchasing in 2020 and 2021 to heal the wounds caused by the COVID-19 pandemic and resulting economy closures. Unlike during GFC, which necessitated a swift, dovish response to stabilize fundamental and systemic issues with the financial system, the case for employing QE in reaction to the pandemic was less clear and led to concerns about its possible impact on inflation. Low interest rates ushered in by QE boosted asset markets and encouraged business activity for many years. Maybe too many, as this year has shown, as bubbles and faulty business models that were perpetuated by flush capital markets have been exposed. Low rates resulting from central bank policies also shifted perceptions about interest rates—today’s federal funds rate of 3.5% – 4.0% would be considered normal prior to QE.

Where we are with inflation in 2022

What do we do to remedy the pain of 2022? Concede to the cash bull market? We do not think so. Instead, understand that what you are experiencing in your portfolio or your 401(k) is not normal. Putting 2022 into perspective, today’s inflation levels and bear market have made the environment for many consumers and investors nearly as tough and challenging as that of the GFC. Or even as difficult as the early 1980s, when inflation reached an all-time high of 15.8% and I was still a kid in this industry. I didn’t have all the answers then, but I understood that if you have spiking fever symptoms, you should go have it checked out by a professional.

Now, the Federal Reserve is again in a position to offer remedies. Perhaps that remedy is already in place. Chairman Powell delivered a strong dose of medicine in the form of four consecutive 0.75% interest rate hikes, with the promise of yet another 0.50% hike in December. The bond and residential real estate markets both responded in kind with massive selloffs. Compared to their predecessors, today’s Federal Reserve has the advantage of better tools and technology, and an ability to draw on the lessons of history. From an investor sentiment standpoint, things have never felt worse. From a contrarian point of view, however, weak investor sentiment may be a good sign! Powell has administered emergency medicine, and we are now waiting for the patient to recover.

But one symptom still remains. The country continues to carry the burden of an enormous debt load – much of it new because of pandemic-related easing. We could afford it when interest rates were near 0%. But not at 4%. Powell needs to reduce inflation to bring down interest rates. So, the key will be breaking the back of inflation. We have seen some signs of inflation cooling recently and the market reacted strongly. We aren’t out of the woods yet and many still believe we are likely heading into a recession, but after the economy flatlined in mid-October, we are still seeing a pulse.

Conclusion

Amid recent signs of life in the markets, we believe there is reason for optimism toward a positive outcome. And there may be another reason to remain optimistic—historically, midterm elections and market returns have exhibited a strong, positive relationship. Looking at the past 19 midterm elections since 1946, the S&P 500 Index has, on average, returned 14.4% over the following 12-month period post the election.¹ It may be time to allow the medicine to take effect.

To close, I want to wish everyone a Happy Thanksgiving with friends and family. We still have much to be thankful for. We at DBR & CO are thankful for earning your trust and the friendships we have formed with families over the past 28 years. I also want to thank our DBR & CO family, as we were again named one of Pittsburgh’s Best Places to Work by the Pittsburgh Business Times. Our dedicated team is truly the reason for this firm-wide recognition.

Thanks for reading.

Sources

¹ Barron’s, November 9, 2022 Wall Street Loves Gridlock, but It Doesn’t Matter. The S&P 500 Has a Record of Surges. https://www.barrons.com/livecoverage/election-day-midterm-results-2022/card/what-the-results-will-mean-for-the-stock-market-VKWPFOaHVpt7QmkjSN5C?mod=article_inline

This material has been provided for general, informational purposes only, represents only a summary of the topics discussed, and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice or recommendations. Rather, they simply reflect the opinions and views of the author. D. B. Root & Company, LLC. does not provide legal, tax, or accounting advice. Before making decisions with legal, tax, or accounting ramifications, you should consult appropriate professionals for advice that is specific to your situation. There can be no assurance that any particular strategy or investment will prove profitable. This document contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information derived from such sources, and take no responsibility therefore. This document contains certain forward-looking statements signaled by words such as "anticipate," "expect", or "believe" that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that the expectations, beliefs, views and opinions expressed in this document will come to pass. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

David B. Root, Jr.

CFP®