Market Commentary | Dec 07, 2021

Addressing Crypto Curiosity

Jeremy L. SuschakCFP®

CFP®

More and more frequently, clients are asking us about cryptocurrencies. Much of the time I find myself posing more questions than providing answers. While popular crypto assets such as Bitcoin and Ethereum very well may be the currency and technology of the future, many speculators have been drawn to the assets driven by the prospect of quick gains. Many longer-term investors, however, continue to view crypto assets as merely speculative technologies rather than an investment or asset to be included in a long-term oriented portfolio.

Before delving too far into the investment merits or crypto’s place in a portfolio, it’s very important to first understand what crypto assets are and how their value is derived.

In their simplest form, crypto assets are payment systems that execute transactions for goods and services. Transactions are executed entirely electronically and do not require authorization of a centralized intermediary such as a bank or payments company. Crypto assets work using a technology called blockchain. Blockchain is a decentralized technology spread across many computers (as many as 60,000 currently) that manage and record online, direct peer-to-peer, tamperproof transactions. What is important, and revolutionary, about blockchain technology is that it enables transactions to be verified without the use of an intermediary, allowing transactions to be executed more quickly and cheaply.

Because cryptocurrencies are entirely decentralized - relying on a properly incentivized network of participants - and not housed in bank accounts, brokerage, or futures accounts, they are not insured by the FDIC or SIPC. In spite of this, many younger investors and traders have been attracted to crypto assets as personal investments. As many as 49 percent of millennials in America are comfortable with investing in cryptocurrency, according to a Bankrate survey.¹

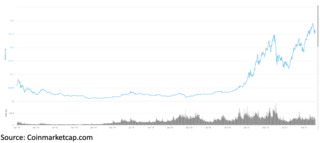

The value of crypto assets has exploded. The total market capitalization of all coins is currently $2.5 trillion, up from $200 billion in January 2020 - a 12.5x increase.² ³

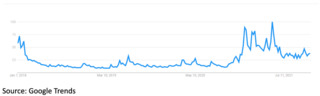

Interest in purchasing crypto assets largely follows the value of the coins. Using Bitcoin as a proxy for crypto interest, increasing search frequency has largely come off the heels of rising prices.

Given all of this information - and there is so much out there - we’ll attempt to answer some of the more frequently asked questions we receive:

How are price and value of crypto assets determined?

The price of a single crypto asset is determined by several factors, including supply and demand, competition, and potential future regulations. Because crypto assets do not generate underlying cash flows, traditional valuation methods, such as those for valuing stocks and bonds, cannot be applied. Therefore, the exercise of valuing crypto assets is more akin to that of commodities or currencies.

Even news developments can influence investor perceptions about cryptocurrencies and impact their values. It’s not unusual for currencies like Bitcoin to increase or decrease in price by 5% or even 10% on any given day. See Elon Musk’s tweets on Dogecoin.

What are the opportunities of investing in cryptocurrency?

A handful of cryptocurrencies have delivered significant returns in a short period of time, such as Bitcoin and Ethereum. Others, however, have not. It is very difficult to forecast what future returns may look like for crypto assets. Each coin is unique, with its own use cases and supply / demand dynamics.

Proponents of crypto argue that technological use cases will increase, as will investor adoption, and these dynamics will drive prices higher. This remains to be seen. From a portfolio management standpoint, crypto assets have historically been less correlated with traditional assets such as stocks and bonds. Including a small allocation of crypto assets in a diversified portfolio of stocks and bonds has historically presented the prospect of higher risk-adjusted returns.

What are the risks of investing in cryptocurrency?

Crypto assets are still highly speculative, and prices remain very volatile. A generally-accepted currency requires stability, so merchants and consumers can determine what a fair price is for goods. However, Bitcoin and other cryptocurrencies have rarely been stable, with price swings of 50% or more occurring in just months. Additionally, current crypto assets are unregulated (an appeal to some), making all investments in cryptocurrencies uninsured by any entity. As crypto assets continue to evolve, tighter regulation and tax treatment may be on the horizon. Governments, such as the United States and China, may even issue their own cryptocurrencies. Each of these developments may impact the prices of current crypto assets.

How and where can I purchase cryptocurrency?

While some cryptocurrencies are available for purchase with U.S. dollars, others require payment with Bitcoins or another cryptocurrency. Accounts on an exchange are required - there are currently more than 500 such exchanges. Careful research to discern which are most reliable is advised. An online app that holds currency, known as a ‘wallet’, is also required. On some exchanges like Coinbase, you can create both a wallet and buy and sell cryptocurrencies. There are also a number of online brokers. While many different wallets exist, each has its own benefits, technical requirements, and security features. Further, exchange traded funds (ETFs) are being unveiled to track the prices of crypto futures. These instruments remain very nascent and may not accurately track the performance of underlying assets. Additional challenges may be present as well, such as asset custody.

The long-term implications of crypto

The possible long-term implications of cryptocurrency may be quite significant. Imagine having the opportunity to fractionalize investments in large assets using tokens as currency? Or having instant and free access to financial assets without intermediaries, clearing processes, and fees? All of this is potentially possible because of blockchain technology.

Further extensions are also exciting. For example, companies could provide profit-shares to employees through company-issued cryptocurrency as equity shares, and cross-border transactions from investments to payroll will save employers and employees money by eliminating banks and language barriers. Crowdfunding and raising capital with a dedicated blockchain wallet could allow fundraisers to avoid third-party fees and keep the amount of donations transparent.

Indeed, crypto very well may change the way we think about money and how we transact with our financial and digital assets.

Conclusion

Diversification and a solid understanding of the assets you own are core tenets of any sound investment strategy. This is perhaps especially true with cryptocurrencies. When exploring crypto, it is critical to be aware of its use cases, risks, and value drivers, and to be prepared for its inherent volatility. While the technology is still in its early stages, the rapidity of its technological change is likely to only increase. And with these swift changes come both opportunity and risk.

As always, please reach out with any thoughts or questions.

Thanks for reading.

Jeremy

This material has been provided for general, informational purposes only, represents only a summary of the topics discussed, and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice or recommendations. Rather, they simply reflect the opinions and views of the author. D. B. Root & Company, LLC. does not provide legal, tax, or accounting advice. Before making decisions with legal, tax, or accounting ramifications, you should consult appropriate professionals for advice that is specific to your situation. There can be no assurance that any particular strategy or investment will prove profitable. This document contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information derived from such sources, and take no responsibility therefore. This document contains certain forward-looking statements signaled by words such as "anticipate," "expect", or "believe" that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that the expectations, beliefs, views and opinions expressed in this document will come to pass. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

Jeremy L. Suschak

CFP®