Education | May 04, 2022

Retirement Catch Up: How to Avoid a Mid-Career Savings Crisis

Steven KohlerCFP®, CPFA®

CFP®, CPFA®

Nancy I. KunzCFP®, CPFA®, ChFC®, CLU®

CFP®, CPFA®, ChFC®, CLU®

There are many reasons that you may delay saving for retirement. Grappling with major expenses, supporting and educating a growing family, and enhancing a lifestyle, it’s easy to lose focus on a seemingly distant goal.

The delayed savings trap impacts nearly 70% of professionals, and high-income earners, business owners, and executives are not immune despite greater capacity. According to a recent Bankrate survey¹ of 2,225 working age Americans, 52% feel they are behind on their retirement savings. A further 16% are not sure whether they’re on track, while 21% say they’re where they need to be. Only 11% said they were ahead of plan.

Getting back on track saving for retirement in your 40s and 50s, though, can be tricky, especially with limited working years ahead.

Regardless of where you stand, there are still a number of tactics you can employ to improve your situation. Most importantly, do not fret. It is never too late to act. While it may require turbo-charging your saving efforts, if you follow the fundamentals and properly allocate your investments, you can avoid falling into a midlife (financial) crisis.

Control your household budget

Your immediate priority should be to get control of your household budget. Review your discretionary spending and endeavor to cut expenses that purely serve to maintain a certain lifestyle. Carefully go through your spending pattern and identify areas where spending can be curbed. You may be surprised at some expenses, and certain areas may be easier to reduce than you think. In addition, eliminating debt should be another priority. Interest payments are not only expensive, but unpaid balances, such as credit cards or personal lines of credit, can compound debt and serve to further increase your interest due. Once you have cleared debts, it will allow room to commit more to your saving goals. Regular review of your expenses and spending habits is an important financial practice regardless of income or retirement standing, however it is especially important as retirement nears.

Prioritize your goals

If you are going to double down on your own savings, you may need to prioritize some of the goals you have set for yourself and your family. For example, if one of your financial goals is to help your children pay their college costs, it's likely that those expenses will occur before you retire. If you keep delaying savings on your list of financial priorities, you may eventually run out of time. If you have to choose between funding your retirement and funding your children's college education, keep in mind that you're probably going to need a lot more money for a comfortable retirement than your kids will need for college. When the time comes for college, your children may qualify for financial aid.

Fully Fund Your 401(k)/Contribute to a Roth IRA

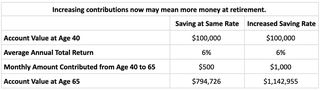

Once you decide to ramp up your efforts, you will want to create a plan for increasing contributions to your retirement savings. Increasing your contribution by even a small amount potentially can have a big impact on your account value. You still could have several years left to accumulate money in your employer retirement plan account. And the sooner you start saving more for retirement, the more time your money will have to benefit from potential compounding:

It's easy to save more for your future. Once you decide to increase your contribution amount, that money will be automatically deducted from your paycheck each pay period and put into your plan where you won't be tempted to spend it on anything else.

Another option is to open an IRA. As with an employer plan, maximizing your IRA contributions and utilizing Roth conversions when appropriate can make a significant difference. A Roth account allows for tax-free compounding, and when withdrawal rules are followed, the withdrawals, including the earnings, will be tax-free. This creates a substantial opportunity for future tax planning, and you can minimize taxable income when you are in the withdrawal phase. Over time the benefits are substantial and help your money last throughout retirement.

Life can get in the way of saving enough for retirement, especially when you are busy with a career, family, and personal priorities important to you in the here and now. However, keep in mind that your future financial security may depend on how much you save during your earning years and how prudently you manage the entirety of your financial situation.

Thanks for reading.

This material has been provided for general, informational purposes only, represents only a summary of the topics discussed, and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice or recommendations. Rather, they simply reflect the opinions and views of the author. D. B. Root & Company, LLC. does not provide legal, tax, or accounting advice. Before making decisions with legal, tax, or accounting ramifications, you should consult appropriate professionals for advice that is specific to your situation. There can be no assurance that any particular strategy or investment will prove profitable. This document contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information derived from such sources, and take no responsibility therefore. This document contains certain forward-looking statements signaled by words such as "anticipate," "expect", or "believe" that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that the expectations, beliefs, views and opinions expressed in this document will come to pass. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

Steven Kohler

CFP®, CPFA®

Chief Planning Officer

Nancy I. Kunz

CFP®, CPFA®, ChFC®, CLU®